- Home

- |

- Investments

- |

- Getting the right mix

Structuring your portfolio

A diversified portfolio is achieved through the process of asset allocation; deciding on the right mix of investments largely depends on three key factors that will combine to determine the appropriate asset allocation for you.

Risk tolerance

The relationship between risk and potential return is direct , and your asset allocation should strike a balance between the two. If you are very risk-averse, then you would likely feel uncomfortable holding a portfolio that is heavily-weighted toward equities. Likewise, if you are comfortable taking on more risk, you would be unlikely to hold a high proportion of cash or government bonds.

Investment goals

The outcome you're looking to achieve has significant influence over the assets you invest in, with different asset classes offering varying return profiles and levels of risk.

If you're looking to achieve high capital returns, and are willing to take on more risk to achieve that, then a higher allocation to equities would be appropriate. Conversely, if you’re looking for a more stable investment that provides you with a regular income stream, then your portfolio would likely have a higher proportion of bonds.

Time frame

The length of time you're looking to invest for will influence your asset allocation as it has a direct impact on the way you are able to manage risk within your portfolio.

If you have a short time frame - of less than two years - it will be harder to reduce investment risk through diversification, as you won't have the time to 'ride out' systemic market volatility. Portfolios that are investing for the short term will likely invest in less-volatile, highly-liquid assets.

Most professionals would advise you to plan to hold investments for five years or longer, as this longer-term time frame enables you to ride out market volatility and opens up a broad range of investment options.

Benefits of a diversified portfolio

When you invest across a range of asset classes, industries and geographies, you reduce the impact a single investment can have on the overall value of your portfolio. Instead, your risk is spread proportionately across the various assets within your portfolio. The key goal of diversification is to reduce the overall risk of a portfolio by investing across a range of assets whose performance have low or negative correlation to each other.

It is important to remember that a diversified portfolio doesn't consist only of a mix of asset classes, but also a range of industries, sectors, geographies and markets, and so a diversified portfolio will also look to invest across a range within each asset class.

A well-diversified portfolio will have a lower level of volatility than a highly-concentrated portfolio, and is likely to provide you with more consistent returns.

Next steps

Identifying an appropriate asset allocation, and building and maintaining a diversified investment portfolio, can be time-intensive, and sometimes daunting for new comers. While some experienced investors choose to manage their investment portfolios independently, you could look for other ways to access an appropriate and diversified portfolio:

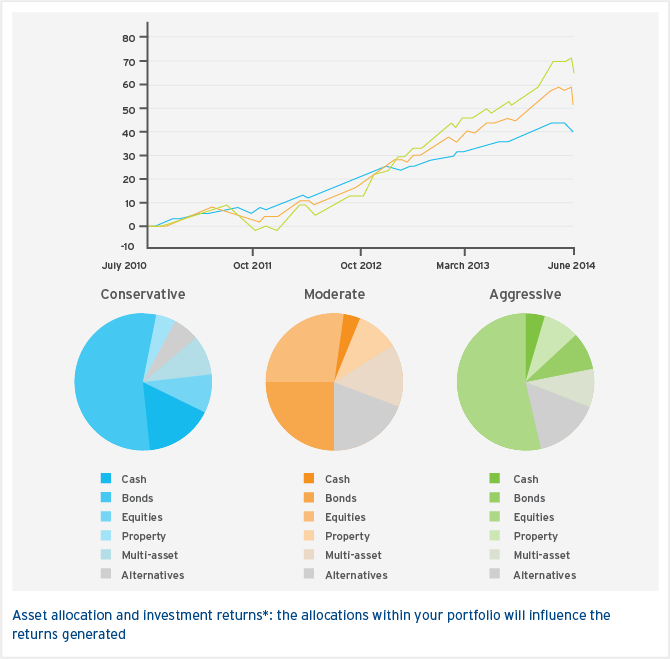

*Source: Mercer Investments (Australia) Limited, 15.10.15. Dividends and coupons reinvested, excluding taxes and transaction costs. Past performance is not an indicator of future performance.

Any advice is general advice only. It was prepared without taking into account your objectives, financial situation, or needs. Before acting on this advice you should consider if it's appropriate for your particular circumstances. You should also obtain and consider the relevant Product Disclosure Statement and terms and conditions before you make a decision about any financial product, and consider if it’s suitable for your objectives, financial situation, or needs. Investors are advised to obtain independent legal, financial, and taxation advice prior to investing.

Investments are not deposits or other obligations of, guaranteed, or insured by Citibank N.A., Citigroup Inc., or any of their affiliates or subsidiaries, or by any local government or insurance agency, and are subject to investment risk, including the possible loss of the principal amount invested. Investors investing in funds denominated in non-local currency should be aware of the risk of exchange rate fluctuations that may cause a loss of principal. Past performance is not an indicator of future performance. Investment products are not available to US people and may not be available in all jurisdictions. All investments are subject to risks and can change in value.