July 4

Synchronised earnings growth a boon for equities

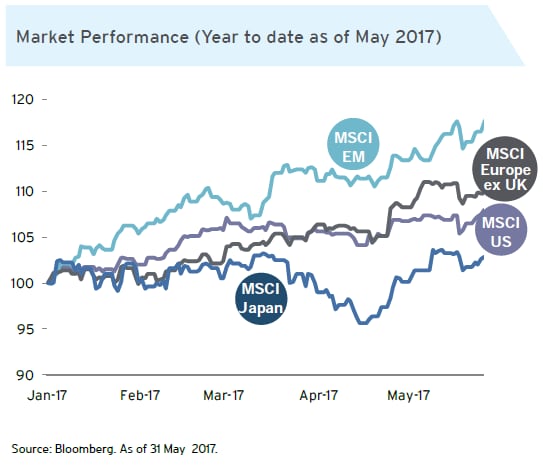

- Citi analysts expect all major regional equity markets to deliver positive earnings growth in 2017, a phenomenon last seen in 2010. However given the rallies to date and lingering geopolitical risks, investors may want to take advantage of market corrections to increase their equity exposures.

- Citi analysts expect all major regional equity markets to deliver positive earnings growth in 2017 on the back of a modest recovery in global growth and oil prices. Global earnings are forecasted to rise 15% this year with earnings growth of 11% expected in the US, 22% in the UK and 19% in Europe ex UK. Japan and the Emerging Markets (EM) are also forecasted to enjoy healthy double-digit earnings growth of 13% and 23% respectively. This is the first synchronised earnings growth across key markets since 2010, a phenomenon which has occurred only seven times since 1990.

- Nevertheless, given that equity market valuations have become more expensive after the rallies year to date, Citi analysts are more selective. As geopolitical risks and policy uncertainties persist, they would take advantage of market corrections to increase their equity exposures.

US Reforms May Still Come Through

- The failure to repeal Obamacare in March 2017, together with the various controversies surrounding the US administration have raised the risks of a delay to President Trump's policy agenda. Accordingly, cyclical stocks and the US dollar have unwound their strong performance post the US presidential election. US bond yields have also climbed lower.

- Citi’s base case remains one where the Republican controlled Congress could succeed in passing US corporate and personal income tax cuts later this year.

- With investors’ low expectations of US tax reforms and fiscal stimulus, any credible progress on Trump’s policy agenda is likely to be positive for cyclical stocks and US equities. Given the lofty valuations of US equities, earnings growth would be important to support the market.

This is the first synchronised earnings growth across key markets since 2010.

Opportunities in EM, Europe and Japan

Citi analysts expect Emerging Markets (EM) to outperform other regional equity markets for the rest of the year.

- EM equities have benefited from a synchronized upturn in growth and inflation globally, still low US interest rates and contained USD strength.

- Citi analysts are positive on Asian ex-Japan, Emerging Europe and Latin America given robust domestic economic growth and attractive valuations. EM equity valuations remain at a historically large discount to the US.

- In particular, Citi analysts favour Asia, especially the large and less trade dependent countries including India, Indonesia and China. Exports account for around 20% of China’s GDP compared to 177% for Singapore and 46% for Korea.

- Earnings for MSCI China may grow 15% in 2017 in Citi’s view although returns are likely to be capped by China’s regulatory tightening and rise in funding costs.

- The recovery in the Eurozone is strengthening and broadening out across countries and economic sectors. Reduced political risks following the French elections are also expected to be supportive of European equities. However, market volatility may rise ahead of the Italian elections. Citi analysts expect strong cash flow generation and healthy company balance sheets to support European dividends, which may help provide investors with some buffer.

- Citi analysts are neutral on Japanese equities. Japanese exporters are likely to benefit from strong US growth and a weaker yen. However, exporter earnings could be at risk if a rise in global risk aversion strengthens the yen.

Take your next step with Citigold

A Bias Towards Cyclical Sectors

Given the improving economic and earnings outlook, Citi analysts are positive on the Energy, Financial and Technology sectors.

- Technology: Earnings momentum is positive, cash generation healthy and balance sheets are strong. Citi analysts also highlight secular growth opportunities generated by continued product innovation.

- Financial: The Financial sector is a clear beneficiary of higher bond yields. Citi analysts prefer EU banks (cheaper valuation, improving macro) to US banks. EM banks are looking increasingly attractive given low valuations and potential improvements in nonperforming loans.

- Energy: Potentially higher oil prices given Citi’s end-2017 forecast of $62/bbl and improved cost discipline may support the Energy sector.

Citi analysts are cautious on the Consumer Discretionary, Utilities, Consumer Staples, Health Care and Telecoms sectors.

Key Takeaways

- With investors’ low expectations of US tax reforms and fiscal stimulus, any credible progress on Trump's policy agenda is likely to be positive for cyclical stocks and US equities.

- Given the improving economic and earnings outlook, Citi analysts are positive on the cyclical sectors which include the Energy, Financial and Technology sectors.

- Citi analysts expect the more cyclical markets such as Japan, Emerging Markets and Europe to outperform the US in 2017.

Note: The Federal Budget is not set in stone, and could change as legislation passes through parliament.

Any advice is general advice only. This document was prepared without taking into account your objectives, financial situation, or needs. Before acting on this advice you should consider if it's appropriate for your particular circumstances. You should also obtain and consider the relevant Product Disclosure Statement and terms and conditions before you make a decision about any financial product, and consider if it's suitable for your objectives, financial situation, or needs. Investors are advised to obtain independent legal, financial, and taxation advice prior to investing. Investment products are not available to US people and may not be available in all jurisdictions. This material is taken from sources which are believed to be accurate, however Citibank accepts no liability of any kind to any person who relies on the information in it.

© 2019 Citigroup Pty Limited. All rights reserved. ABN 88 004 325 080, AFSL No. 238098, Australian credit licence 238098. Citi, Citi and Arc Design and other marks used herein are service marks of Citigroup Inc. or its affiliates, used and registered throughout the world.