July 4

Distracted Trump pumps US dollar volatility

Citi analysts remain optimistic and still expect US tax reforms to be passed over the next 12 months. However, political developments could distract the US administration in the near term, resulting in a period of volatility for the US dollar (USD).

A Volatile Dollar

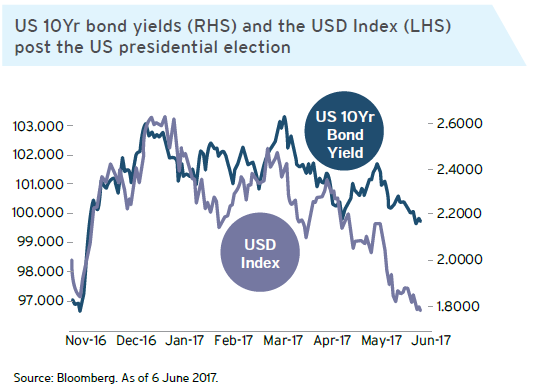

- Expectations of US rate hikes, sizeable fiscal stimulus and tax reform under the Trump administration have helped underpin the USD since December last year and into early 2017.

- Since February, sentiment gradually shifted with investors expecting Trump’s policy and economic agenda to take longer to draft and implement. This has seen US rates and USD reverse. See Figure.

- Citi analysts remain optimistic and still expect tax reforms equivalent to a fiscal impulse of 1 to 1.5% of GDP in 2018-2022 to be passed over the next 12 months. However, political developments could distract the US administration and prompt investors to look for better opportunities elsewhere until more clarity emerges.

- USD is likely to be volatile within a range of 96.00 to 101.00 on the USD Index. US political headlines are likely to keep a lid on USD gains but further Fed rate hikes can limit the dollar's downside.

EUR Could Benefit From Dollar Weakness

- This potentially creates opportunities for short term investors. Politically induced USD weakness is likely to benefit the EUR given strengthening economic fundamentals and receding political risks in Europe. However, Europe's slow normalization process can temper the EUR's upside. The European Central Bank (ECB) is only expected to raise interest rates in June 2019, after it starts reducing its monthly bond purchases in early 2018.

- That said, the USD could still outperform the EUR during periods of heightened market volatility. While other traditional safe havens such as the JPY and CHF could appeal to investors as well, rate differentials would probably favour the dollar as the Fed raises rates while the Bank of Japan and the Swiss National Bank keep rates steady.

AUD Appears Vulnerable

- Among the commodity currencies, the AUD is likely to be the most vulnerable given weak economic fundamentals and the negative outlook for iron ore prices.

- Prospects for New Zealand appear brighter and Citi analysts expect the Reserve Bank of New Zealand to raise interest rates by the first quarter of 2018. Meanwhile, the CAD is likely to be boosted by higher oil prices over the remainder of the year. On balance, the three commodity currencies are expected to underperform the EUR and GBP.

CNY Broadly Stable

- Citi analysts expect the Chinese Yuan (CNY) to stay broadly stable for the rest of the year as we approach the National Congress of the Communist Party in October/November. Foreign exchange reserves have risen for a 3rd straight month in April and capital outflows have been subdued.

- While Citi analysts see most of the Emerging Asian currencies ending the year softer, higher yields make the INR and IDR relatively attractive. Citi analysts see INR outperforming other emerging Asian currencies given attractive carry, strong fundamentals and continued equity inflows. The Reserve Bank of India is also less likely to cut interest rates, as it sees the strong INR as a product of a stronger economy.

- Citi analysts expect Singapore's central bank, the Monetary Authority of Singapore (MAS), to keep monetary policy conditions accommodative for the rest of 2017 given muted demand and a weak labour market. Singapore's economic growth is also unlikely to exceed the upper end of the MAS's official forecast of 1-3%. This suggests that the SGD can further weaken moderately against the USD and other higher yielding Asian currencies such as the IDR and INR.

Take your next step with Citigold

Key Takeaways

- USD weakness is likely to benefit the EUR given strengthening economic fundamentals and receding political risks in Europe.

- AUD appears most vulnerable among the commodity currencies given weak economic fundamentals and the negative outlook for iron ore prices.

- Citi analysts expect the CNY to stay broadly stable for the rest of the year as we approach the National Congress of the Communist Party in October/November.

Note: The Federal Budget is not set in stone, and could change as legislation passes through parliament.

Any advice is general advice only. This document was prepared without taking into account your objectives, financial situation, or needs. Before acting on this advice you should consider if it's appropriate for your particular circumstances. You should also obtain and consider the relevant Product Disclosure Statement and terms and conditions before you make a decision about any financial product, and consider if it's suitable for your objectives, financial situation, or needs. Investors are advised to obtain independent legal, financial, and taxation advice prior to investing. Investment products are not available to US people and may not be available in all jurisdictions. This material is taken from sources which are believed to be accurate, however Citibank accepts no liability of any kind to any person who relies on the information in it.

© 2019 Citigroup Pty Limited. All rights reserved. ABN 88 004 325 080, AFSL No. 238098, Australian credit licence 238098. Citi, Citi and Arc Design and other marks used herein are service marks of Citigroup Inc. or its affiliates, used and registered throughout the world.