- Home

- |

- Investments

- |

- Forex contracts

Features and benefits

Citibank offer two types of forex contracts; Forward and Watching. Both contracts have:

Forward Contracts allow you to lock in an exchange rate now, for conversion at a specified future date, giving you surety of the rate you will convert at.

If your conversion date is flexible, you could look at a Watching Contract, which mandates Citibank to monitor the forex market on your behalf and convert currency if your preferred rate is reached.

Potential risks

Both types of forex contract are designed to help you manage your currency risk. However, your decisions around contract terms are based on your expectation of currency movement; there is the risk that you may have called the market incorrectly, and so would have been better off converting at the current or future market rate.

Learn more

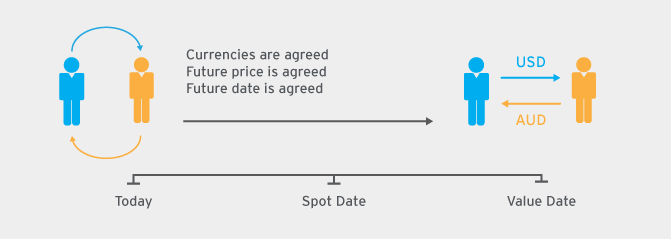

Forward Contracts

Forward Contracts allow you to lock in an exchange rate now, for conversion at a specified future date, giving you surety of the rate you will convert at; you agree the amount, rate and date that a conversion will be made, and at the 'value date' the exchange will happen on those terms:

Forward contracts are useful if you know you have a future obligation in another currency - for example, education fees or buying a holiday home overseas - but think that the exchange rate will move against you; by taking out a forward contract, you know exactly what rate you will be paying when that future obligation comes due.

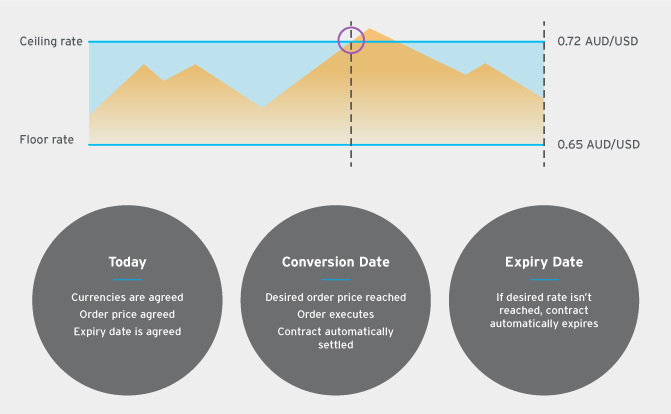

Watching Contracts

Watching Contracts set exchange rate levels at which you would like your money to convert; they require Citibank to monitor the market on your behalf and convert currency if your preferred rate is reached.

You can set one or both of floor and ceiling levels for currency conversion; if either is hit, your money will be exchanged. This means that you can make sure conversion will only happen at a rate you are comfortable with. If the rate(s) set in the contract are not achieved, your currency will not be converted.

Press play to hear more about foreign currency at Citibank.

How to invest

Citibank’s Forward and Watching Contracts have a minimum investment of USD$20,000, or the equivalent in another currency.

You can find out how to take advantage of Forward and Watching Contracts by referring to our How To Invest page.

Issued by Citigroup Pty Limited ABN 88 004 325 080 AFSL 238098.

Any advice is general advice only. It was prepared without taking into account your objectives, financial situation, or needs. Before acting on this advice you should consider if it's appropriate for your particular circumstances. You should also obtain and consider the relevant Product Disclosure Statement and terms and conditions before you make a decision about any financial product, and consider if it’s suitable for your objectives, financial situation, or needs. Investors are advised to obtain independent legal, financial, and taxation advice prior to investing.

Investments are not deposits or other obligations of, guaranteed, or insured by Citibank N.A., Citigroup Inc., or any of their affiliates or subsidiaries, or by any local government or insurance agency, and are subject to investment risk, including the possible loss of the principal amount invested. Past performance is not an indicator of future performance. Investors investing in funds denominated in non-local currency should be aware of the risk of exchange rate fluctuations that may cause a loss of principal. Investment products are not available to US people and may not be available in all jurisdictions.

Terms and conditions apply.